Our mortgage calculator is designed to help you understand your potential monthly payments and make informed decisions about your home financing. Simply enter the details below to get started.

At Home Connect, we believe in transparency. It’s essential to understand all the costs involved in a real estate transaction, whether you’re buying or selling a home. This page provides a detailed breakdown of the typical costs you can expect.

Closing costs are fees associated with the finalization of a real estate transaction. They typically include lender fees, title fees, escrow, and government recording fees. Here’s a closer look at common closing costs:

Charged by the lender for processing your loan application.

Protects you and the lender from potential legal issues with the property’s title.

Covers the cost of a professional appraisal to determine the property’s value.

Fees charged by the local government to record the sale

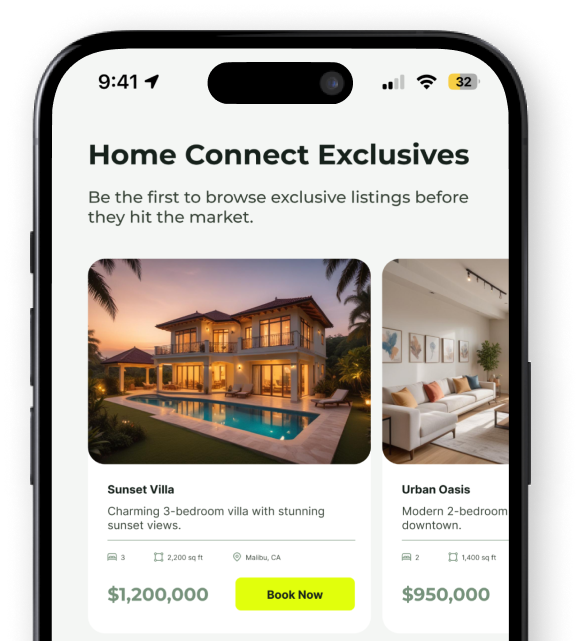

From buying to selling, we cover all your real estate needs.

Some closing costs may be negotiable.

Invest in necessary repairs and improvements that can increase your home’s value and marketability.

Disclaimer: Home Connect is not a real estate brokerage, real estate agent, or law firm, nor do we provide legal, financial, or real estate services. We are a platform designed to facilitate direct connections between buyers and sellers. Home Connect does not represent buyers or sellers in transactions, nor do we offer legal or professional real estate advice. Users are encouraged to consult with licensed real estate professionals, attorneys, or financial advisors before making any real estate decisions.

| Title | Price | Status | Type | Area | Purpose | Bedrooms | Bathrooms |

|---|